Wholesale prices unexpectedly declined 0.1% in August, as Fed rate decision looms

CNBC Television

23,438 views • 4 months ago

Video Summary

The August Producer Price Index (PPI) report revealed a surprising decrease, with the headline number falling 0.1% and the core PPI (excluding food and energy) also dropping 0.1%. This marks the first negative print since April and suggests a moderation in wholesale inflation, potentially easing concerns that have been building.

These figures contrast with the previous month's gains, where both headline and core PPI rose by 0.9% and were subsequently revised down to 0.7%. The year-over-year data also showed significant improvement, with headline PPI at 2.6% and core PPI at 2.8%, the lowest levels seen since June and April, respectively. This deceleration in wholesale inflation could be a positive sign for the broader economy.

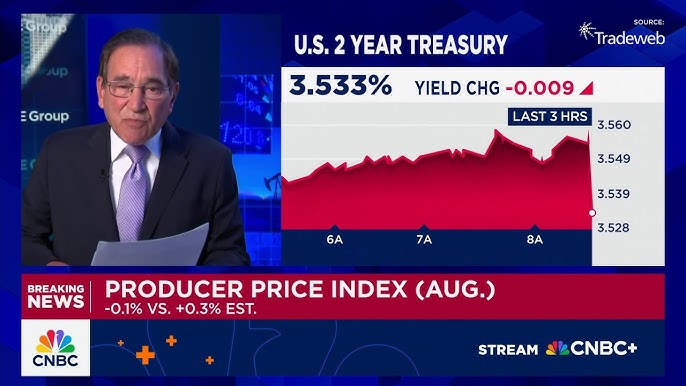

The market reacted to the news, with interest rates seeing a slight dip. The 10-year Treasury yield fell to around 4.06%, down three basis points, and the 2-year Treasury saw a similar three-basis-point decline, settling at 3.52%. Despite these drops, the 10-year yield remains above the key 4% mark, which was its low for the year.

Short Highlights

- August headline PPI fell 0.1%, the first negative number since April.

- Core PPI (excluding food and energy) also decreased by 0.1%.

- Year-over-year headline PPI was 2.6%, the lowest since June.

- Year-over-year core PPI was 2.8%, the lowest since April.

- 10-year Treasury yields dropped to around 4.06%, and 2-year yields to 3.52%.

Key Details

August PPI Report: Headline and Core [00:10]

- The headline Producer Price Index (PPI) for August was expected to be up 0.3% but instead fell 0.1%.

- This marks the first negative PPI number since April, when it was -0.2%.

- Excluding food and energy, the core PPI was also expected to be up 0.3% but came in at -0.1%.

- This is the first negative core PPI since April, matching the headline number.

- Last month, both headline and core PPI were up 0.9% and have been revised down slightly to 0.7%.

The August PPI report delivered a surprise with a 0.1% decrease in the headline figure and a matching 0.1% drop in core PPI, signaling a potential slowdown in wholesale inflation and a positive development following recent upward trends.

"Down one/tenth of a percent. Down one10enth. Wow."

PPI Excluding Food, Energy, and Trade [00:54]

- This category, often referred to as "trimmed mean" or "supercore," was expected to be up 0.3%.

- It came in as expected, up 0.3%.

- This 0.3% increase is the smallest gain since June of this year.

This specific measure of inflation, which removes volatile components, showed a modest increase, but its growth rate is the slowest observed since June, further contributing to the picture of moderating inflation.

Year-Over-Year PPI Data [01:10]

- Year-over-year headline PPI came in at 2.6%, significantly lower than the expected 3.3%.

- This 2.6% figure is the lowest since June of this year, when it was 2.4%.

- Year-over-year core PPI (excluding food and energy) registered at 2.8%, below the expected 3.5%.

- This 2.8% reading is the smallest since April of this year, when it was also 2.8%.

These year-over-year figures represent a notable deceleration in inflation, with both headline and core rates reaching multi-month lows, indicating sustained progress in bringing down wholesale price pressures.

"In my opinion, these are the most important and boy, I'm surprised, real progress here."

Final PPI Reading: Excluding Food, Energy, and Trade [01:53]

- This figure, excluding food, energy, and trade, was up 2.8%.

- This matches the previous month's reading of 2.8%, marking two consecutive months at this level.

- The previous month's 2.8% was a significant upward revision from -0.9% initially reported.

- For comparison, the reading in June was 2.5%.

- The year started with this specific PPI measure at 3.5%, indicating a clear moderation.

This specific PPI metric, which accounts for a broad range of goods and services, shows consistent deceleration, reinforcing the overall trend of easing wholesale inflation seen throughout the report.

Market Reaction and Interest Rates [02:17]

- The positive inflation news led to equities moving up.

- This is because it paints a potentially better labor market picture and mitigates immediate inflation worries.

- Interest rates on the 10-year Treasury have dropped to around 4.06%, down three basis points.

- The 2-year Treasury also fell three basis points, trading at 3.52%.

- Despite the drops, the 10-year yield remains above the 4% level, which was its low for the year.

The market's positive response, with rising stocks and falling yields, reflects the relief from persistent inflation concerns, although key interest rate levels remain a point of focus.

"And now the inflation worry, at least on the wholesale side, gets mitigated a bit."

Other People Also See